Posted on March 21, 2023

The Basics of Online Investing for Beginners

Online investing is an increasingly popular way for individuals to manage their financial portfolios. It offers convenience, flexibility, and a wide range of investment options which can make it attractive to a broad range of investors. For those new to the world of online investing, however, the process can seem overwhelming.

Types of Accounts

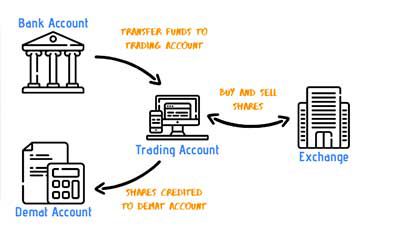

When it comes to online investing, there are a variety of account types to choose from. The most common type of account is a brokerage account, which is managed by a broker and provides access to a wide range of investments. There are also robo-advisors, which are automated services that provide portfolio management and advice with minimal human intervention. If you're looking to know more about online investing then you may browse this website.

Image Source: Google

Getting Started

Once you’ve chosen the type of account that best suits your needs, the next step is to open the account and fund it. Most online brokers will require you to provide basic information such as your name, address, and Social Security number. You will also need to make an initial deposit, which can vary depending on the broker or account type.

Research and Investing Strategy

Once your account is open and funded, you will need to do some research and develop an investing strategy. This includes researching different investments, such as stocks, bonds, mutual funds, and ETFs, to determine which ones are the best fit for your goals. You should also consider your risk tolerance and create an asset allocation plan that will help you reach your goals.

Monitoring and Adjusting

Once you have developed an investing strategy, it is important to regularly monitor and adjust your portfolio. This includes staying up to date on the performance of your investments, as well as making changes when necessary. Additionally, you should be aware of any fees associated with your investments and be mindful of tax implications.